I used to only think about taxes in April. But as my income increased and diversified, I ran into surprise tax bills and penalties. I then created complicated spreadsheets, read the IRS tax code and paid my accountant a lot.

For most tax situations, people shouldn't have to do any of that, so I built TaxEstimate.fyi to share my tax estimation solution with everyone.

The Surprise Tax Bill

Like most people, I started earning a salaried income with taxes withheld each paycheck. Every April, I'd pay a bit to turbotax, enter some data, and get a small refund or pay a few hundred. A bit annoying, but no big deal.

As the years passed, my salary increased, and I started adding new income sources (selling stocks, interest income, etc.). Still, I assumed my prior of leaving taxes off until April would be fine—the additional non-withheld income sources weren't big.

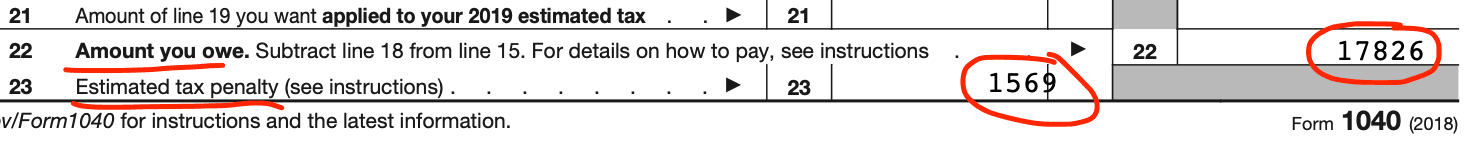

But one April:

Turbotax said I owed $17,826 and a $1,569 penalty for underpayment!

Shocked, I spent the rest of my day digging through income statements and my tax return, looking for some obvious mistake. By the end, I realized there was no mistake, and I actually owed $17,826. Time to sell a bunch of stock(more taxes!) to pay it off.

So why was it so off? At first I checked my W-4 Witholding Document, but that was filled as "no allowances", maximum withholding. It turns out the federally mandated withholding amounts diverge from what you actually owe, and this divergence increases the more income you have. This is silly, because the IRS knows exactly how much we owe, so why not just withhold that amount? #IRS

The Excel Spreadsheet

So I got serious to avoid any future surprise bills/penalties. I read the IRS tax code, made an excel spreadsheet, and consulted an accountant. Over the years I continued refining it, adding more complexity as income sources diversified, and getting it closer to what I actually owed—eventually just a few hundred dollars off.

But the spreadsheet had its limits. Without code it couldn't handle many edge cases well, so it was littered with workarounds. Which meant I often didn't fully trust the spreadsheet when making updates.

Furthermore, whenever I told the story of my spreadsheet to coworkers, I discovered most of them have the same tax estimation issue. They "solve" it by either paying an accountant a lot, eating the penalties, or guestimating their taxes and hoping for the best.

TaxEstimate.fyi

So I decided to make a webapp out of my spreadsheet: TaxEstimate.fyi—you can clearly see the spreadsheet design influences.

I think it's better than what's out there (smartasset, turbotax, IRS) for a few reasons:

Quick & Easy Input

I tried the IRS withholding estimator multiple times. But it's so long and complicated that I've always given up before the end.

TaxEstimate.fyi lets you to quickly add your income sources and get immediate cumulative calculations.

Intra-Year Tax Calculations

All other calculators ask your full year's income, then give you a single number. But people's income is distributed, often unevenly, throughout the year. TaxEstimate.fyi uniquely lets you select any date in the year, and see how much you owe up to that date. This is great for quarterly payments, because you won't need to redo an estimation 4 separate times.

Transparent Calculations

I hate how all the estimators just give you a final number with zero or minimal explanation. It really erodes trust if I don't know where the number comes from. TaxEstimate.fyi lets you click into each tax component to see a detailed breakdown of how it's calculated, along with relevant links to the official IRS tax code.

Save & Update

People have taxable events throughout the year, i.e. deciding to sell some stock. When that happens, no one wants to redo an entire tax estimation to include that one change. TaxEstimate.fyi lets you save your tax estimate and update just that one component later. This makes it easy to keep track of all your income sources and tax liabilities throughout the year.

I hope you find this tool useful! If you don't, it doesn't cover your use case, or have any other suggestions, I'd love to hear from you. Shoot me a message at contact@taxestimate.fyi.

Matthew Tse, Creator of TaxEstimate.fyi